+998 71 205 19 19

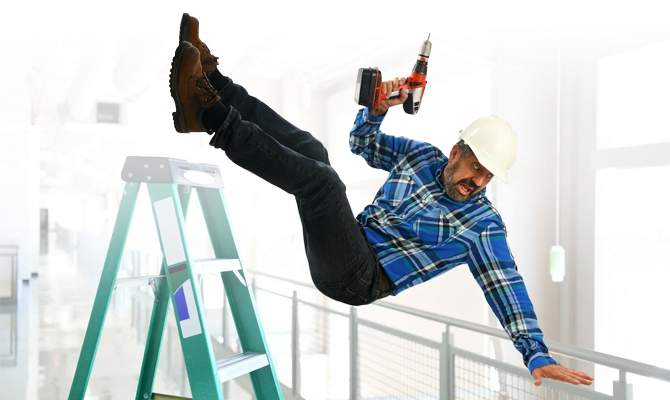

1. Широкий спектр покрываемых рисков:

• Полис покрывает телесные повреждения, нападение злоумышленников или животных, потерю трудоспособности, инвалидность и смерть.

2. Надежная защита:

• Обеспечивает финансовую поддержку в трудных жизненных ситуациях, связанных с несчастными случаями.

Что мы покрываем:

• Телесные повреждения.

• Нападение злоумышленников или животных.

• Потеря трудоспособности или временная нетрудоспособность.

• Установление инвалидности I или II группы.

• Смерть в результате несчастного случая.

Заключение полиса:

Для оформления полиса страхования от несчастных случаев требуется предоставить паспорт и медицинскую справку о состоянии здоровья (в некоторых случаях).

После предоставления необходимых документов и оплаты страховой премии, полис будет выдан на указанный срок.

Преимущества страхования от несчастных случаев

Финансовая защита

Обеспечивает выплату компенсаций в случае телесных повреждений, потери трудоспособности и других непредвиденных обстоятельств.

Спокойствие и уверенность

Позволяет чувствовать себя защищенным в любых ситуациях, связанных с несчастными случаями.

Гибкие условия

Возможность выбора программы страхования, которая наилучшим образом отвечает потребностям клиента.

Какие случаи покрываются полисом страхования от несчастных случаев?

1.

Полис покрывает телесные повреждения, нападение злоумышленников или животных, потерю трудоспособности, инвалидность и смерть в результате несчастного случая.

Что делать в случае наступления страхового случая?

1.

Необходимо уведомить страховую компанию и предоставить медицинские документы, подтверждающие факт несчастного случая.

Какие факторы влияют на стоимость полиса страхования от несчастных случаев?

1.

Стоимость полиса зависит от уровня риска, связанного с конкретным видом деятельности, состояния здоровья и возраста клиента.